The candle stick role in live forex:

A candle stick outline is a sort of diagram, as well as a specialized device, used to recognize exchanging designs a money pair. The graph is addressed by square shape blocks with vertical lines at the top and the base, looking like a candle and its wick. Each 'candle' addresses the opening and close costs of a cash pair, while the 'wick' addresses the intraday ups and downs.

Candle Graph:

A candle graph is one of the most straightforward ways of following cost developments in Forex and distinguish a pattern (for example up or descending pattern). Candle outlines are a possibility for merchants utilizing MetaTrader 4 and MetaTrader 5 . They are not difficult to empower through the primary toolbar, principal menu and a console easy route and are the most famous choice among MT4 brokers with regards to perceiving the market patterns.

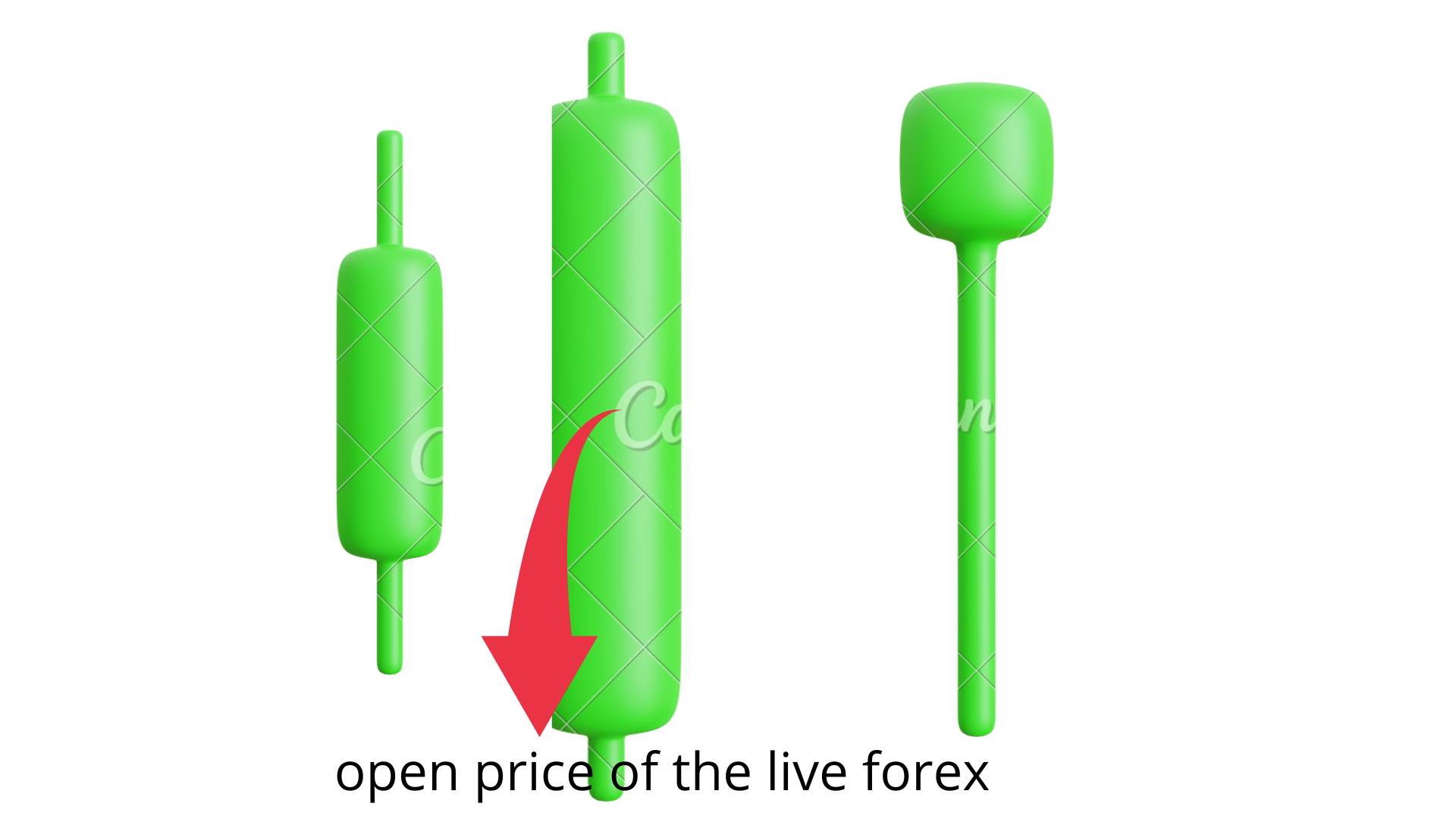

Determine Open price of the live market :

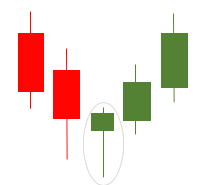

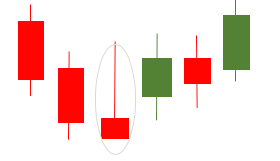

The initial cost of a cash pair is addressed by the level line at the top or the lower part of a flame, contingent upon whether the pair is going up or down. It's the worth of a money pair toward the beginning of an exchanging meeting. On a standard candle outline, where varieties have not been changed, a white light demonstrates the cost is falling. Hence, the initial cost is the even line at the highest point of the light. The dark and green light demonstrates the cost is expanding. In this way, the level line at the lower part of the candle. If it's not too much trouble, see underneath graph for reference.

Determine Close Price of the forex market:

The nearby cost is demonstrated by the flat line lined up with the initial cost line. Once more, this is dependant on whether the candle is going up or down. Assuming it is climbing, the nearby cost is addressed by the level line at the highest point of the flame. The other way around assuming the cost is going down. The nearby cost is the last worth of the cash pair inside a 24-hour exchanging session.The variety conspire on the candle graphs can be changed to suit the client's inclination. In the beneath graph, for instance, the red candles show a cost fall while the green candles demonstrate a cost range.

Higher Price Lower Price:

The upward lines at each finish of the flame address the most elevated and the least exchanging values arrived at over the course of the day. The top line - or the wick - being the most noteworthy worth a cash pair has reached during the meeting and the primary concern being the least worth reached.A range is the cost distinction between the intraday low and the intraday high, typically addressed as a rate or in pips.

Function of candle stick chart pattern :

Examples can arise inside a light itself or a progression of candles. Here are some famous candle patterns you ought to know about. These pattern very help full for during trade and find out the very good behavior of the live forex and through this way trade most of experts remains active to change the direction of tha forex market.

The Hammer candle stick pattern:

A 'hammer' candle development is a bullish inversion design that shows up during a descending pattern. At the point when a cash pair is falling in value, a 'hammer' recommends the cost will begin rising. A 'hammer' candle has a little body and a long base wick, with practically no top wick.

The hanging man pattern:

A 'hanging man' candle is something contrary to a 'hammer' however looks basically the same. A hanging man shows a negative inversion design during a vertical pattern, recommending the money pair has arrived at its high and venders are going to assume command. Once more, the body of the light is little, and the base wick is normally two times or multiple times the size.

The inverted Hammer pattern :

Like the sledge, an 'rearranged hammer' shows a bullish inversion example or cost change toward the finish of a descending pattern. The upset sledge is distinguished by a little body and a lengthy top wick, where the meeting's high is two times or multiple times the size of the body. There is next to zero base wick.

The shooting star candle stick pattern :

A meteorite seems to be a rearranged hammer, however it shows up at the highest point of a vertical pattern, demonstrating a negative inversion. Like an upset sledge, it has a long upper wick (or upper shadow) and next to zero lower wick. The long upper wick recommends the market tried an obstruction level, where bears pushed the cost lower.

The neglected child candle stick pattern:

A neglected child isn't quite so normal as the past candle patterns talked about. An 'neglected child' is a negative inversion design at the low of a descending pattern. It shows up with a market 'hole' lower and a limited exchanging range (body). The 'hole' between candles is brought about by selling late night or through fates, yet when the market resumes, new venders neglect to show up. Very much like the candle's name, this pattern seems as though two bigger candles have 'deserted' another, at a lower level.

Bullish forex live market:

A positively trending market is a monetary market which is expanding in esteem, energized by purchasers. It's generally portrayed as a monetary market which ascends by 20% in esteem after a 20% decay and goes on for a drawn out timeframe, whether that is months or years. A positively trending business sector can be distinguished on a candle graph by a progression of new 'better upsides' and 'more promising low points'. The following is a day to day candle diagram of forex market pair. You can see the cost of gold has been on a vertical pattern throughout recent months. Regardless of a fall in February, the general cost is moving higher. Thusly, this is a positively trending market.

Bearish forex live market:

A bear market is the direct inverse of a buyer market and can be recognized as a 20% decrease in a monetary market or money pair, in the wake of expanding. In a candle diagram, a bear market is obvious through a progression of 'worse high points' and 'worse low points' over a lengthy timeframe. The following is a candle out line of forex live market money pair. The outline shows the pair of forex live market move gradually declining throughout the time span, with merchants assuming command over the money pair, in this manner uncovering a bear market.

0 Comments